Sustainability | Free Full-Text | Premiums for Non-Sustainable and Sustainable Components of Market Volatility: Evidence from the Korean Stock Market

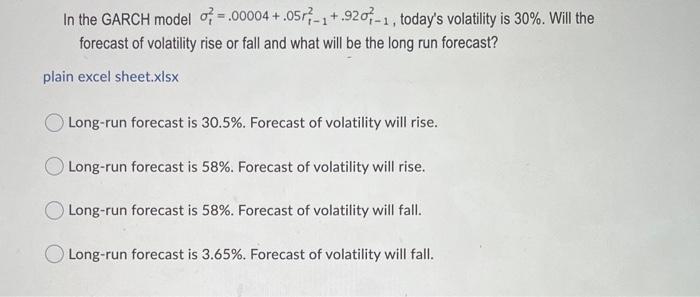

Potential Drivers of Bitcoin Long-Run Volatility Using GARCH-MIDAS Model | by Harry zheng | Coinmonks | Medium

Mathematics | Free Full-Text | Financial Volatility Modeling with the GARCH-MIDAS-LSTM Approach: The Effects of Economic Expectations, Geopolitical Risks and Industrial Production during COVID-19

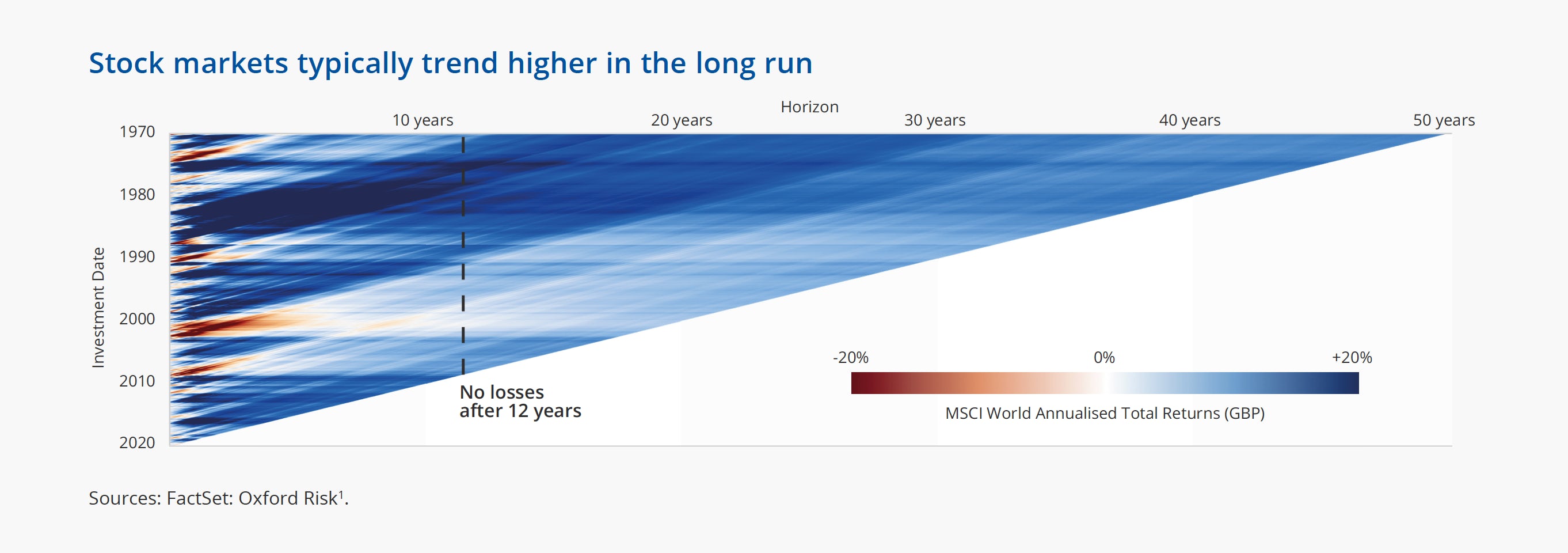

Effect of the long-run disaster risk on the volatility of the risk-free... | Download Scientific Diagram

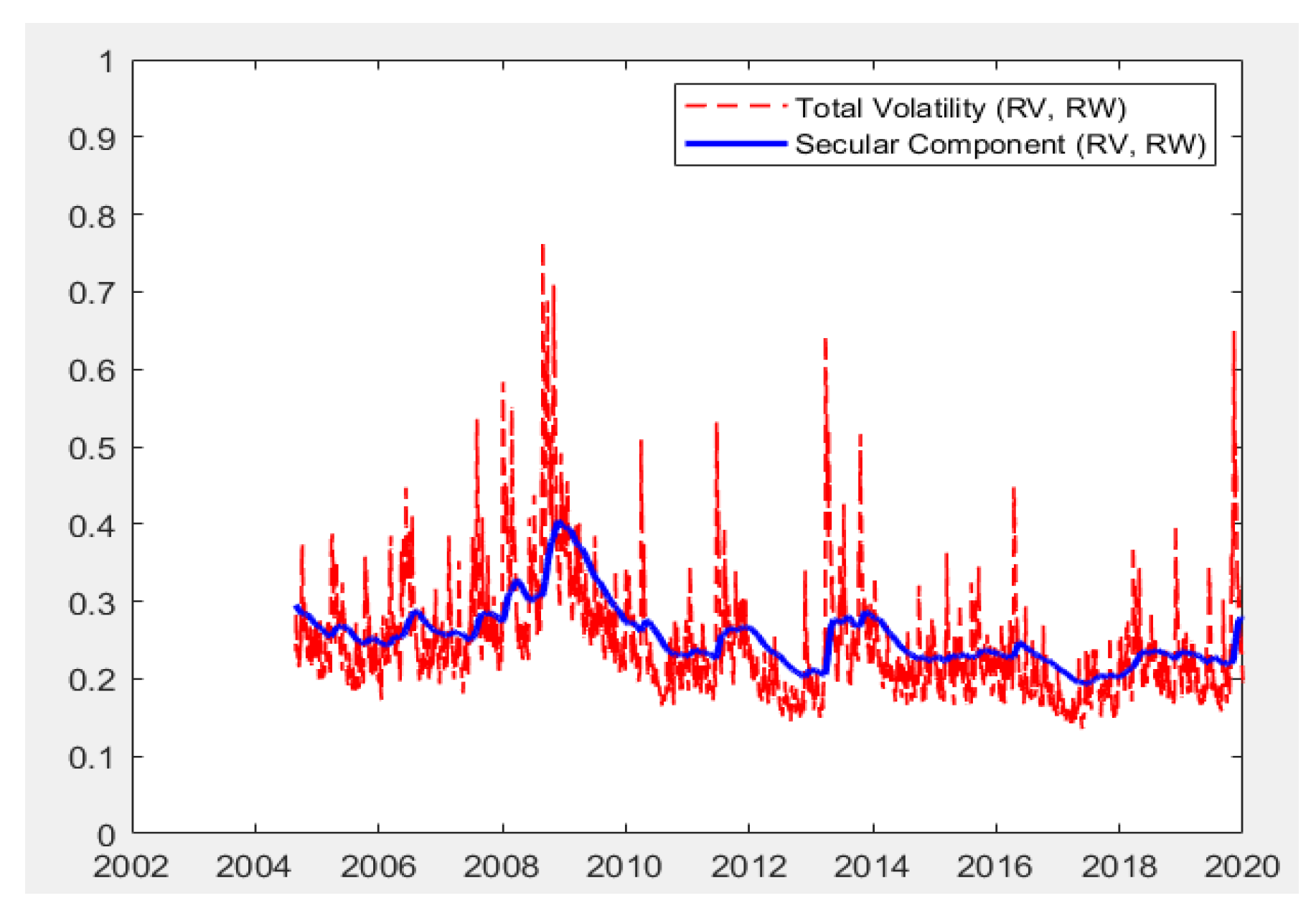

GARCH-MIDAS with realized volatility. This figure shows the volatility... | Download Scientific Diagram

![PDF] The Short-Run and Long-Run Components of Idiosyncratic Volatility and Stock Returns | Semantic Scholar PDF] The Short-Run and Long-Run Components of Idiosyncratic Volatility and Stock Returns | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/3ef39ac51fee7dae3e34e287ef9b31d2e94a82d7/34-Table4-1.png)

PDF] The Short-Run and Long-Run Components of Idiosyncratic Volatility and Stock Returns | Semantic Scholar

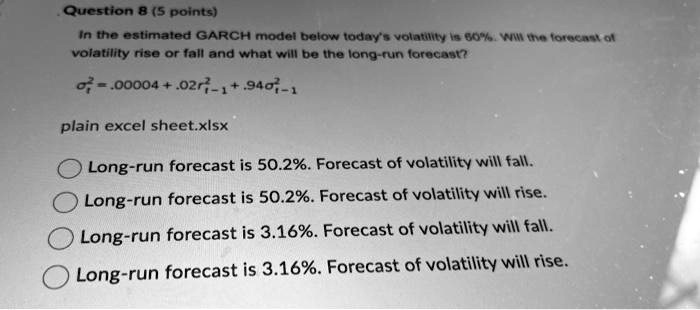

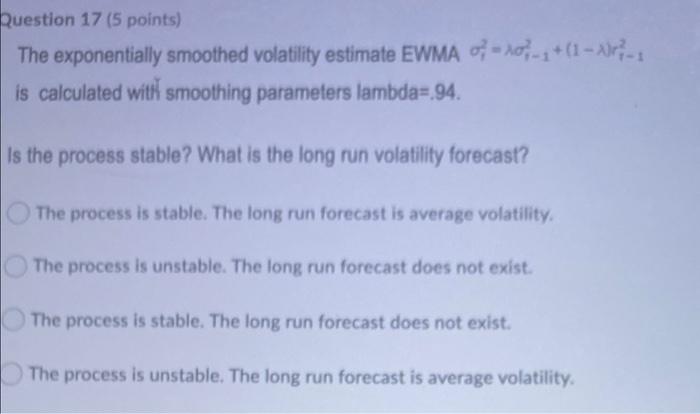

How to build a Garch (1.1) model with an EWMA filter for a volatility process (time series, garch, statistics) - Quora

Fitting of conditional variance and long-run components of volatility... | Download Scientific Diagram

Fitting of conditional variance and long-run components of volatility... | Download Scientific Diagram

Fitting of conditional variance and long-run components of volatility... | Download Scientific Diagram

![PDF] Long-Run Volatility and Risk Around Mergers and Acquisitions | Semantic Scholar PDF] Long-Run Volatility and Risk Around Mergers and Acquisitions | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/e24b2dc63053459f88383e921c2158e99105be5e/34-Figure1-1.png)